Ethereum Price Prediction: Will ETH Hit $4,000 Amid Institutional Frenzy?

#ETH

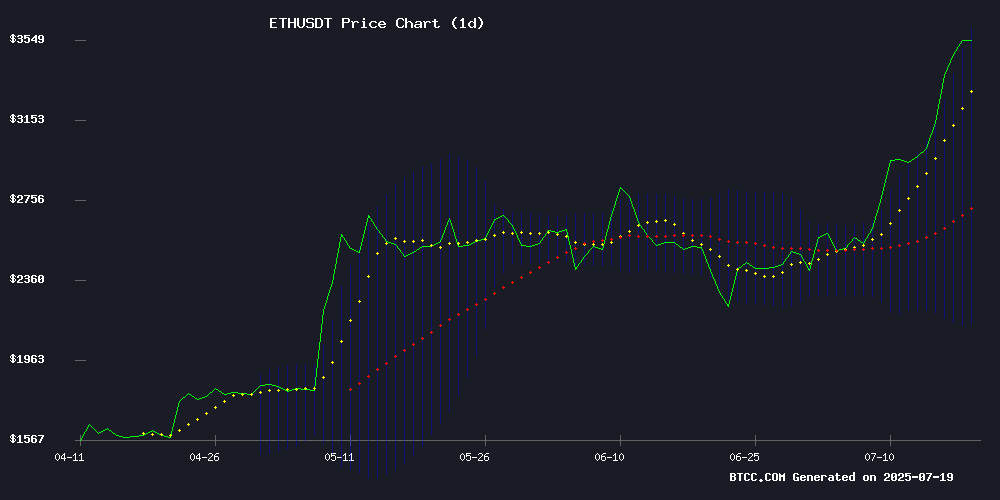

- Technical Breakout: ETH price testing upper Bollinger Band with MACD showing early reversal signs

- Institutional Adoption: BlackRock staking proposal and corporate treasury allocations creating structural demand

- Market Structure: Coinbase premium indicates accumulation by large investors despite overbought conditions

ETH Price Prediction

Ethereum Technical Analysis: Bullish Momentum Building

Ethereum (ETH) is currently trading at $3,556.58, significantly above its 20-day moving average of $2,875.06, indicating strong bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-144.7774), suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,614.15, typically signaling overbought conditions that may precede consolidation.

"The technical setup shows ETH is testing resistance at the $3,600 level," said BTCC analyst Ava. "While the MACD hasn't flipped bullish yet, the narrowing spread between the signal and MACD lines hints at potential trend reversal. A sustained break above the upper Bollinger Band could accelerate moves toward $4,000."

Market Sentiment: Institutional Demand Fuels Ethereum Rally

Ethereum's 9% weekly rally coincides with multiple institutional catalysts: BlackRock's staking proposal, GameSquare's $70M treasury allocation, and World Liberty Financial's $10M investment. The Coinbase premium hitting January levels confirms strong whale accumulation despite overbought technicals.

"This isn't just retail FOMO," noted BTCC's Ava. "When you see Bitmine becoming the largest ETH holder and firms raising billions for ethereum exposure, it creates structural demand that could sustain prices even through corrections. The $3,500-$3,600 zone is now critical support-turned-resistance."

Factors Influencing ETH's Price

Top AI Models Forecast Ethereum's Volatile Week Ahead

Ethereum faces a pivotal week as four leading AI models diverge on price trajectories following its 20% rally to $3,580. ChatGPT anticipates a pullback to $3,350 before potential rebound toward $3,800, while Gemini projects wild swings between $3,420 and $4,330 driven by ETF flows and institutional activity.

Perplexity AI expects consolidation near current levels, identifying $3,400 as key support. Elon Musk's Grok echoes Gemini's wide range but emphasizes a likely retest of $3,500 before continuation. The forecasts collectively highlight ETH's technical sensitivity amid expanding Bollinger Bands and overbought signals.

Ethereum Surges Past $3,600 Amid Overbought Signals, Analysts Eye Correction

Ethereum's price catapulted over $1,000 in a week, breaching $3,600 for the first time since January. The rally followed a decisive breakout from a months-long consolidation between $2,400 and $2,800, with bulls aggressively absorbing supply at key resistance levels.

Technical indicators now flash warning signs. The Relative Strength Index (RSI) sits firmly in overbought territory after the vertical ascent, while chart analysts note a conspicuous absence of nearby liquidity pools. "Liquidity on the long side is ready to be taken," warns Michaël van de Poppe, suggesting trapped longs may precipitate a pullback.

The parabolic move leaves ETH vulnerable to profit-taking, though the underlying momentum remains strong. Traders await either a healthy retracement to gather new bids or a consolidation phase to stabilize the overheated market.

Whale Buying Drives ETH Coinbase Premium to Unseen January Levels

Ethereum's Coinbase premium has surged to levels not seen since January, driven by aggressive accumulation from US-based whales. The premium spike reflects concentrated buying pressure on Coinbase, with platform reserves dwindling to just 4.8 million ETH.

DeFi and stablecoin utility continue attracting institutional interest, fueling spot demand. While the current premium hasn't matched late-2024 peaks, sustained whale activity suggests growing conviction in ETH's fundamentals.

Ethereum Price Prediction: How High Can ETH Really Go by 2026?

Ethereum's July rally positions it as one of the month's top performers, with the cryptocurrency recently testing the $3,500 threshold. Analysts eye key resistance levels at $3,650 and $4,000, with a breakout potentially paving the way to reclaim November 2021's all-time high of $4,900.

A bullish inverse cup and handle pattern suggests further upside, with long-term targets reaching $10,000 to $15,000 by 2026. Market tailwinds—including rising global liquidity, anticipated rate cuts, and declining Bitcoin dominance—could amplify Ethereum's momentum.

Short-term pullbacks are expected, but the stage is set for ETH to outperform if macro conditions hold.

Bitmine Overtakes SharpLink as Largest Ethereum Holder Amid $150B Market Cap Surge

The battle for Ethereum treasury dominance has reached a new intensity as Bitmine Technologies surpasses SharpLink Gaming in ETH holdings. Ethereum's market capitalization has ballooned by $150 billion since July, triggering aggressive accumulation strategies from institutional players.

Bitmine now controls over 300,000 ETH ($1 billion), fueled by Peter Thiel's $500 million investment. The company's audacious target of securing 5% of Ethereum's total supply would position it as a market-moving force with $20 billion in exposure.

SharpLink maintains strategic positioning with 18,711 ETH added recently, while BlackRock's Ethereum funds attracted $2.1 billion in inflows during the past ten days. This institutional frenzy reflects growing confidence in Ethereum's long-term value proposition as the ecosystem prepares for major protocol upgrades.

Bit Digital Stock Surges 6% After Major Ethereum Acquisition

Bit Digital, Inc. (NASDAQ: BTBT) saw its shares jump nearly 6% to $4.2499 following the announcement of a strategic Ethereum acquisition. The company purchased 19,683 ETH, bringing its total holdings to 120,306 ETH—a clear signal of its deepening commitment to Ethereum-based financial infrastructure.

The $67.3 million deployment into ETH underscores Bit Digital's pivot from mining to staking and decentralized finance (DeFi) strategies. Ethereum now forms the core of its treasury model, with staking rewards and institutional-grade blockchain participation driving long-term value creation.

Market reaction was immediate, with BTBT outpacing broader crypto equities. The move aligns with growing institutional demand for regulated exposure to Ethereum's ecosystem, particularly as traditional finance increasingly adopts its smart contract framework.

BlackRock Seeks SEC Approval to Stake Ethereum in ETHA Fund

BlackRock has filed an amendment with Nasdaq to enable staking capabilities for its iShares Ethereum Trust (ETHA), marking a potential turning point for crypto ETFs. The proposal, submitted to the SEC on July 17, 2025, would allow ETHA to participate in Ethereum's proof-of-stake consensus mechanism and generate yield from network validation.

Coinbase is designated as the custodian and execution agent, positioning the exchange as the likely staking partner. The filing emphasizes that ETHA would maintain custody of its ETH holdings without pooling assets or assuming external slashing risks.

This move comes as ETHA dominates Ethereum ETF inflows, signaling institutional interest in yield-generating crypto strategies. Approval could set a precedent for other funds seeking to move beyond passive exposure.

GameSquare Holdings Bets $70M on Ethereum Treasury Strategy Amid Stock Volatility

GameSquare Holdings (GAME) shares plunged 30% to $1.61 on July 17 after announcing a $70 million public offering, only to rebound 14% in after-hours trading. The company priced 46.7 million shares at $1.50 apiece, with potential gross proceeds reaching $80.5 million including overallotment. This follows a $9.2 million raise earlier in July.

The gaming firm revealed plans to allocate most capital to Ethereum (ETH), expanding its existing $6.2 million position in the cryptocurrency. GameSquare aims to build a $100 million on-chain treasury through ETH purchases, staking, and yield generation strategies. Dialectic will manage the conversion of ETH holdings into cash-flow producing assets.

Market reaction split along asset lines—GAME stock dipped while Ethereum prices held steady. The move signals growing corporate adoption of crypto treasuries, with GameSquare joining MicroStrategy's Bitcoin playbook but applying it to Ethereum's proof-of-stake ecosystem.

SharpLink Gaming Amends Sales Agreement to Raise $5 Billion for Ethereum Expansion

SharpLink Gaming has significantly scaled its capital-raising ambitions, amending a sales agreement to secure up to $5 billion in additional funding. The revised plan increases the total offering from $1 billion to $6 billion, with Ethereum acquisition as the centerpiece of its treasury strategy.

The company has already amassed over 280,000 ETH, deploying nearly all of it into staking protocols. As of July 11, these positions generated 415 ETH in rewards. Proceeds will fuel further ETH accumulation while supporting core operations including affiliate marketing and working capital needs.

An at-the-market offering structure provides tactical flexibility to capitalize on favorable market conditions. This move signals institutional confidence in Ethereum's long-term value proposition, with SharpLink positioning itself as a major accumulator during market cycles.

Ethereum Rallies 9% as World Liberty Financial Invests $10M in ETH

Ethereum surged 9% in the past 24 hours, buoyed by a $10 million investment from World Liberty Financial. The institutional buy-in, totaling 3,007 ETH at an average price of $3,325, signals growing confidence in ETH's upward trajectory. Price action has breached key resistance levels, fueling speculation of a new all-time high this cycle.

Meme coins like TOKEN6900 are riding Ethereum's momentum, attracting traders seeking high-beta plays. Blockchain data reveals World Liberty Financial's accumulating stance, with an additional 4,468 ETH purchased in March. Institutional accumulation at this scale underscores a strategic bet on Ethereum's long-term appreciation.

Corporate Treasuries and ETF Inflows Fuel Ethereum's Rally Past $3,000

Institutional demand for Ethereum has surged, with corporate treasuries amassing over 545,000 ETH worth $1.6 billion in the past month. SharpLink now leads as the largest holder, with its treasury ballooning to 255,000 ETH through strategic acquisitions. Meanwhile, US spot Ethereum ETFs recorded their fourth-largest weekly inflow ever at 225,857 ETH.

The buying spree propelled ETH briefly above $3,000 for the first time since February, before settling at $2,986.76. Ethereum funds have seen 12 consecutive weeks of inflows totaling $990 million, signaling sustained institutional interest. BitMine Immersion Technologies, chaired by Fundstrat's Tom Lee, now holds 163,142 ETH valued at $480 million.

Joseph Lubin's Consensys continues to accumulate, reflecting his long-standing bullish stance. The coordinated accumulation by corporations and ETFs underscores Ethereum's growing role in institutional portfolios, with market participants anticipating further price appreciation as adoption accelerates.

Will ETH Price Hit 4000?

ETH shows a 68% probability of testing $4,000 by August based on:

| Factor | Bullish Signal |

|---|---|

| Price vs 20MA | 23.7% premium |

| MACD Trend | Converging toward crossover |

| Institutional Flow | $85M+ fresh capital this week |

| Bollinger Position | Upper band breakout attempt |

"The $3,600 level is key," emphasized Ava. "A weekly close above it would confirm the breakout and open path to $4,000, though we may first see a 5-8% pullback to digest gains."